Candy companies want to know: What will make Americans start chewing gum again?

Gum’s bubble burst during the COVID-19 pandemic, when masks and social distancing made bad breath less of a worry and fewer people spent on impulse buys. The number of packages of gum sold dropped by nearly a third in the United States in 2020, according to Circana, a market research firm.

Consumer demand has picked up only slightly since then. Last year, U.S. chewing gum sales rose less than 1% to 1.2 billion units, which was still 32% fewer than in 2018. Although sales in dollars are back to pre-pandemic levels, that’s mostly due to inflation; the average pack of gum cost $2.71 last year, $1.01 more than it did in 2018, Circana said.

It’s a similar story globally. Worldwide gum sales rose 5% last year to more than $16 billion, according to market researcher Euromonitor. That still was 10% below the 2018 sales figure.

Some manufacturers are responding to the bland demand by leaving the market altogether. In 2022, Mondelez International sold its U.S., Canadian and European gum business, including brands like Trident, Bubblicious, Dentyne and Chiclets, to Amsterdam-based Perfetti Van Melle.

Chicago-based Mondelez, which makes Oreos and Cadbury chocolates, said it wanted to shift resources to brands with higher growth opportunities.

Other American confectioners are cutting slow-selling brands. Ferrera Candy Co., which is headquartered in Forest Park, Illinois, quietly ended production of Fruit Stripe and Super Bubble gums in 2022 after more than 50 years.

Chewing gum is fighting more than a virus, however, when its comes to regaining its flavor. Lynn Dornblaser, the director of innovation and insight at market research firm Mintel, said a growing number of consumers are trying to limit sugar in their diets and to eat foods with more natural ingredients. That limits the appeal of gum, since even sugar-free varieties often contain artificial sweeteners.

U.S. consumers, like those in Europe and Asia, also may be increasingly concerned about the stubborn litter from used gum, Dornblaser said. Singapore famously banned the sale, import and manufacturing of chewing gum in 1992, blaming the careless disposal of the substance on subways for gumming up service. More recently, the U.K. government persuaded gum manufacturers to pay for a street-cleaning program to help remove gum and gum stains.

Dan Sadler, a principal for client insights at Circana, has noticed generational differences in gum chewing.

Generation X, the cohort born between 1965 and 1980, tends to chew gum more than other age groups, he said. Millennials generally show less interest in gum and candy, while Generation Z consumers are more interested in novelty candies like sour gummies. Nielsen says U.S. unit sales of gummies rose 2.5% over the last year and 4% the year before.

Mars Inc., which owns the 133-year-old Wrigley brand, thinks it may have an answer: repositioning gum as an instant stress reliever rather than an occasional breath freshener. In January, the company launched a global ad campaign promoting its top-selling Orbit, Extra, Freedent and Yida brands as tools for mental well-being.

Alyona Fedorchenko, vice president for global gum and mints in Mars’ snacking division, said the idea stuck in the summer of 2020, when the company was frantically researching ways to revive sales.

Fedorchenko remembered talking to a nurse in a hospital COVID-19 ward who chewed gum to calm herself even though she always wore a mask. The nurse’s habit meshed with studies by Mars that showed half of chewers reached for gum to relieve stress or boost concentration.

“That, for us, was the big ‘Aha!’” Fedorchenko said. “We’ve had a century of legacy of fresh breath, and that is still very important. Don’t get me wrong. But there is so much more this category can be.”

Emphasizing wellness is part of a multi-year effort to attract 10 million new U.S. chewers by 2030, she said. Mars also is introducing new products like Respawn by 5 gum, which is aimed at gamers. The gum contains green tea and vitamin B, and the company promotes those ingredients as a way to help improve focus. Sold in three flavors, Respawn by 5 could lure customers from smaller brands like Rev Energy Gum, which contains caffeine.

Megan Schwichtenberg, a public relations account director from Minneapolis, buys into the idea of gum as a quick respite. She often chews a piece of fruit-flavored Mentos gum when she’s driving or at the gym, and finds that chewing gum stops her from clenching her jaw during the workday.

“If I’m sitting at a desk all day managing a team, I can’t get up and go punch a punching bag,” Schwichtenberg said. “It’s a way to contain some of that in the space you’re in.”

But not everyone finds gum enhances well-being. Kylie Faildo, a pelvic floor physical therapist in Denver, thinks artificial sweeteners and swallowing air while chewing made her bloating symptoms worse. She gave up gum two years ago and doesn’t plan to go back, even though she misses the ease of popping a piece into her mouth before meeting a client.

“I use mouthwash a lot more now,” Faildo said.

Caron Proschan, the founder and CEO of the natural gum brand Simply, said she thinks U.S. gum sales slowed due to a shortage of innovation. Young customers have little disposable income and many distractions, she said, so gum needs to be compelling.

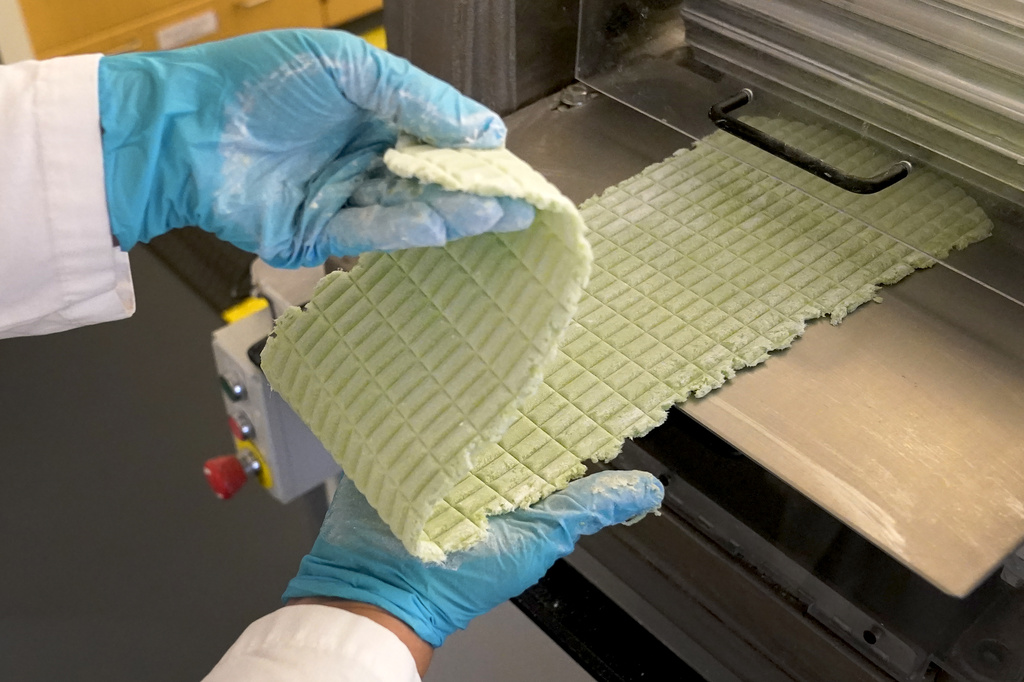

Simply – which makes gum from a type of tree sap called chicle instead of synthetic ingredients – has seen its sales double every year since 2021 without raising prices, Proschan said.

“Consumers today care about ingredients. They care about quality. The chewing gum category was not evolving to meet the needs of this consumer,” she said.

Sadler and Dornblaser say they still see growth ahead for gum, but it needs to adapt to customers’ changing tastes and buying habits, including a shift from impulse sales to online shopping.

Some brands, like the U.K.’s Nuud Gum, are offering subscription plans, for example. Other gum makers are experimenting with pop-up ads that remind customers to add gum to their food delivery orders.

(AP)