New York State Department of Taxation and Finance Acting Commissioner Jamie Woodward announced today that nearly 800,000 taxpayers may be eligible to participate in the new Penalty and Interest Discount (PAID) Program, a plan offering substantial reductions in penalty and interest charges to people who pay off older tax debts.

New York State Department of Taxation and Finance Acting Commissioner Jamie Woodward announced today that nearly 800,000 taxpayers may be eligible to participate in the new Penalty and Interest Discount (PAID) Program, a plan offering substantial reductions in penalty and interest charges to people who pay off older tax debts.

As part of the state’s Deficit Reduction Plan, qualifying taxpayers will have between January 15, 2010, and March 15, 2010, to both sign up for PAID and pay off their older tax liabilities.

Governor David A. Paterson said, “This program is mutually beneficial to both taxpayers and the state government. It would provide much-needed revenue to the state during an unprecedented fiscal crisis, while also helping taxpayers repair their credit histories and avoid costly legal action.”

The program reduces by 80 percent the penalty and interest charges accrued on unpaid tax bills that are more than six years old, and by 50 percent on tax bills that are more than three years old but less than six years old.

Tax bills issued after December 31, 2006, are not eligible for this program.

The program begins January 15, 2010. In order to realize any savings, eligible taxpayers must make all payments by the program’s expiration date, March 15, 2010.

The Tax Department will begin mailing letters to people who might qualify for the PAID program, inviting them to participate. Due to the age of some of the debts, not every eligible taxpayer can be reached by mail.

Acting Commissioner Woodward said, “While we are taking additional steps to attempt to secure current address information, the department will not be able to reach every eligible taxpayer through the mail. We have, therefore, posted information on our web site that will guide people who have questions about their eligibility. Anyone can check to see if they have a liability that they may have lost track of, but they should check before the program ends or they won’t be able to take advantage of the savings.

“Pursuant to the law that created this program, we will not be able to provide this debt forgiveness opportunity after March 15, 2010. Taxpayers who believe they are eligible for PAID should visit our website, www.nystax.gov starting January 15, 2010, to learn more. Taxpayers without web access can also call (518) 457-1726 or 1 (888) 272-9697 starting January 15 for further information and instructions,” Acting Commissioner Woodward said.

(YWN Desk – NYC)

3 Responses

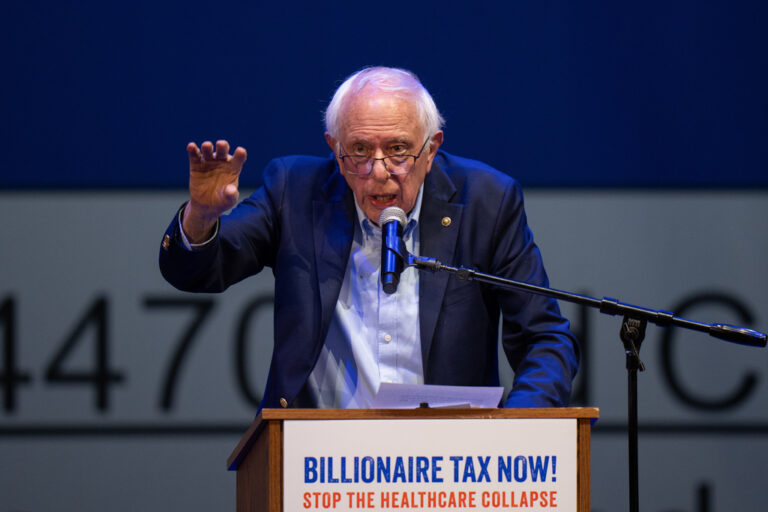

Why do you have a picture of “Uncle Sam” (who symbolizes the Federal government, that’s what the U.S. stands for) when the article is about New York State government???

akuperma, maybe you can answer a better question for me; why was an I.R.S. investigator passing by my house on Monday? On the bus, she kept on changing where she was going and why. Wouldn’t you love it if I got an I.R.S. audit, right?

And this is for all of my political enemies who view me as a threat to the Jewish electoral base of the Democratic Party I say this; whichever Republican candidate endorses the repeal of the 16th amendment and commits to shutting down the I.R.S. gets my vote. Now all of you put that in your respective pipes and smoke it!