[THIS IS A PAID ADVERTISEMENT]

[THIS IS A PAID ADVERTISEMENT]

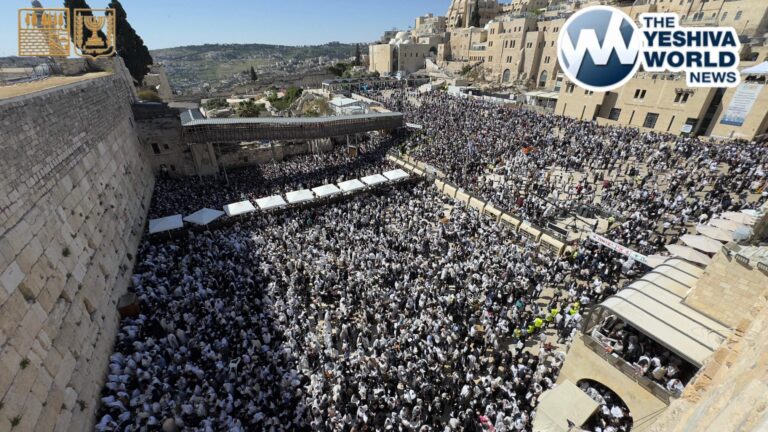

After over seven years of successfully managing Jerusalem properties for investors and homeowners living in America, England, and Europe, London born Shia Getter, CEO of The Shia Getter Group, decided to expand into uncharted territories. Having studied property management and buyer advocacy overseas, he saw the need Israel to have its first professional buyer brokerage service similar to what exists in the USA. For those unfamiliar with the concept, a buyer’s broker is essentially a liaison between the buyer and the real estate agent and sellers. As broker, Shia’s job is to advocate for the best interest of the buyer, navigating the murky waters of Israeli banking and government bureaucracy, as well as dealing with real estate agents, price negotiations and selecting the perfect location.

“Many people abroad are considering buying properties in Yerushalayim – either for vacation homes or as pure investments – but are afraid of dealing with all the foreign headaches,” Reb Shia explained. “They want someone they can trust to walk them through the process and ensure they make the best investment possible.” This led Shia to establish The Buyer’s Brokerage, the only way to have someone totally on your team when buying property in eretz Yisrael.

His first buyer’s brokerage client was Reb Moshe Gluck* from London, who was looking to invest $2 million in Jerusalem real estate. Reb Moshe is a respected and successful businessman and the different project developers in Jerusalem were vying for his business. Already managing six of Reb Moshe’s Jerusalem apartments, Reb Moshe’s chose Shia to represent him “I had been burned before by people who tried to pull the wool over my eyes,” Reb Moshe recalled. “Shia Getter came highly recommended and his affordable flat fee was well worth it. I know my business, but it’s much harder to read the fine print when it’s written in Hebrew. I’ll break my head learning up Rishonim on a sugyia but Hebrew legal jargon is quite another story.”

After carefully reviewing all of the options, Reb Moshe decided upon a brand new high-class development in one of Jerusalem’s up-and-coming neighborhoods. The developer gave Reb Moshe a choice between two golden opportunities: either to obtain a partnership in the entire project, or to get a 40% discount per meter of apartment. On one hand, if Reb Nachum became a partner in the project, he would stand to make a significant amount when everything was sold. On the other hand, buying rooms at a discount would give him a guaranteed profit and sold control of his assets.

After a strategy session of careful analysis, Shia advised him to take the per room option, reasoning that a project of this scope would take years to build and sell. Israeli bureaucracy being what it is, you can never know what type of complications could delay construction, drain profits, or even compromise the entire project.

And so it was.

After the project got off the ground, the Antiquities Authority demanded preservation of certain historical elements on the site, skyrocketing the costs way beyond initial estimates and delaying construction. Had Reb Moshe become a partner in the project, he would have made far less of a return that the “realistic” projections he was shown up front.

Considering his reputation as an expert businessman, Reb Moshe knew how to close a deal – however being a foreigner to the Israeli system, put him at a disadvantage. Shia met with the developer and attorneys, making sure Reb Moshe’s best interests were being fully met. At the time of the signing, Shia noticed a clause left in the contract that linked the purchase price to the rate of inflation (madad) – which would jack up the final price higher than the agreed upon deal! Reb Moshe’s lawyer hadn’t even noticed. Shia insisted that the line be struck off or they would walk away from the deal. Crossing out that line saved Reb Moshe $180,000!

“When I try to imagine what it would be like to manage all of them without having someone on the scene who I can totally trust — I don’t know how I would do it,” Reb Moshe said. “How do you find the right place? What if the place needs renovations? Who will deal with the contractors? Who will take care of the place in your absence? If you don’t have the right people who can be there, right on top of the situation, you’re talking about a full-time headache. But I’ve got The Shia Getter Group working for me — I don’t have those worries.”

By getting buyers representation from The Shia Getter Group, investors like Reb Moshe are able to sleep more peacefully at night, knowing that someone with their best interests at heart is taking care of their properties. “Paying the $5,000 flat rate for Shia Getter Buyer’s Brokerage is one of the best investments an investor or buyer of property in Israel can possibly make,” Reb Moshe said. “I can’t reiterate how much money and headache it saved me.”

Mr. Getter is coming to the United States for a wedding. He has set aside several days from his busy schedule to meet with Yeshiva World News readers interested in discussing their options on November 19 to 21. Serious parties should contact (718) 473-3950 or [email protected] to schedule.

_____________________________________________________________________

Shia Getter is the CEO of the Shia Getter Group, a full range real estate services firm in Jerusalem catering to the Anglo Investor. He is a noted expert, columnist, and author of the forthcoming book, “The Guide to Investing in Jerusalem Real Estate.” Together, he and his professional team manage many upscale Jerusalem properties and have helped countless people buy, sell, and renovate property in Israel.

*Name changed for privacy