The Obama administration on Thursday announced a set of financial regulations that would force companies to disclosure more information about their owners, part of an effort billed as a crackdown on tax evaders and money launderers.

The Obama administration on Thursday announced a set of financial regulations that would force companies to disclosure more information about their owners, part of an effort billed as a crackdown on tax evaders and money launderers.

Administration officials announced the new rules as Treasury Secretary Jacob Lew urged Congress to pass legislation that would further enhance transparency in the U.S. banking system and help law enforcement track down secret owners.

“Illicit financial activity is a critical concern for the United States and our partners around the world,” Lew wrote in a letter to congressional leaders Thursday. “Additional statutory authority is necessary to put the United States in the strongest position to combat bad actors who seek to hide their financial dealings and evade their tax responsibilities.”

Lew’s letter came as Treasury finalized the so-called “customer due diligence” rule dictating how banks to keep records on who owns the companies that use their services.

A second proposed rule would close a loophole that allows a narrow class of foreign-owned companies to avoid reporting to the IRS.

The administration’s push came after the leak of the “Panama Papers,” a trove of financial records that detailed the breadth of international tax dodging through offshore, secret accounts. Experts noted the U.S. is emerging as a top tax haven to rival Switzerland or the Cayman Islands, as U.S. laws allows banks to promise foreigners secrecy.

Treasury also sent new legislation to Congress that would require companies to know and disclose their owners to the IRS and to allow law enforcement to access that information. Lew also urged senators to ratify eight tax treaties that have languished in the Senate. The treaties, he told lawmakers, are critical “to ensure fair and full enforcement of our tax laws.”

Lew also pushed lawmakers to pass legislation requiring U.S. bank and other financials to collect and disclose more detailed information about foreign account holders — information it requires foreign banks to disclosure about Americans to collect, but doesn’t reciprocate.

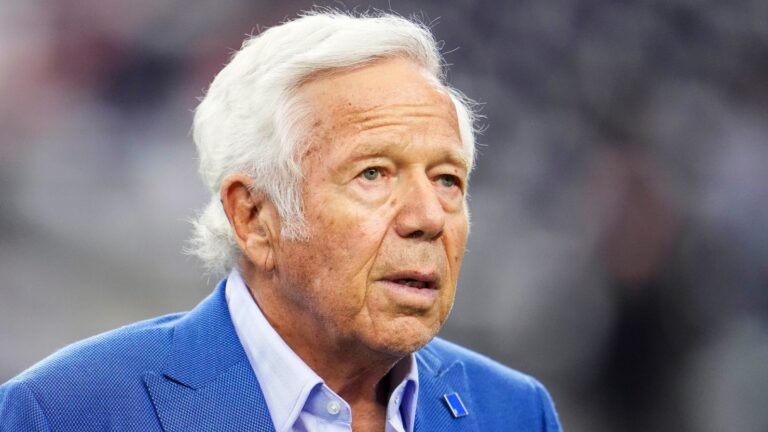

(AP)