Congress and President Donald Trump reached agreement Tuesday on a nearly $500 billion coronavirus relief bill that would replenish a small business rescue program and provide new funds for hospitals and a virus testing program.

The Senate is poised to quickly pass it in a late afternoon session. It next goes to the House.

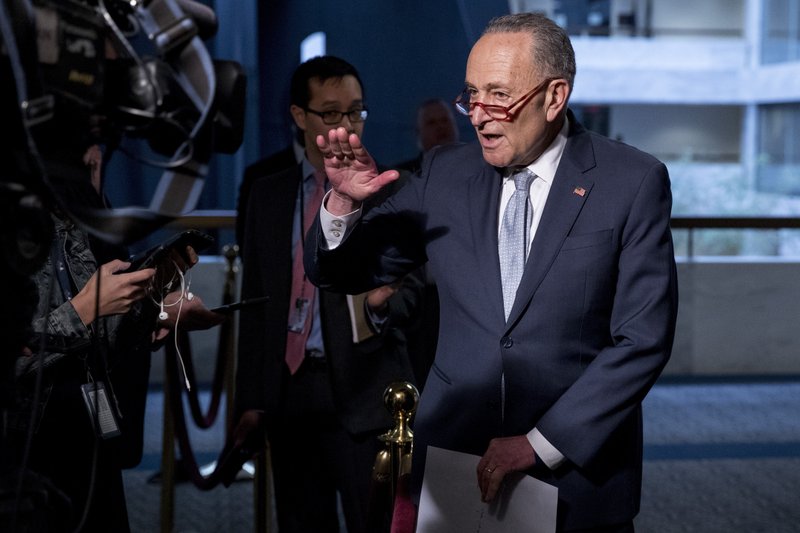

Senate Majority Leader Mitch McConnell, R-Ky., and Senate Democratic leader Chuck Schumer, were among the few senators in the chamber amid stay-home orders that have shuttered Washington, and the nation.

Two conservative Republicans, Sen. Mike Lee, R-Utah, and Sen. Rand Paul, R-Ky., were prepared to voice opposition. But they are not expected to halt passage.

Lee said it was “unacceptable” that the full Senate was not present and voting in the pro forma session, citing a strict reading of the Constitution.

The agreement was announced by Schumer earlier Tuesday and Trump tweeted his support, saying he’ll sign the bill if passes both chambers. McConnell swung behind it as well.

“I welcome this bipartisan agreement and hope the Senate will quickly pass it,” McConnell said.

As he opened the Senate, he called it a “significant package.”

McConnell will seek to clear the bill through the GOP-held Senate during a Tuesday afternoon session, which would take unanimous agreement among all senators.

A copy of the measure was provided to The Associated Press by a GOP aide.

Schumer said the bill was made “better and broader” after Democrats forced the inclusion of money for hospitals and testing..

Schumer said post-midnight talks among leaders of both parties and top Trump administration officials produced a breakthrough agreement on the package.

Trump said he supports the measure, tweeting, “I urge the Senate and House to pass the Paycheck Protection Program and Health Care Enhancement Act with additional funding.”

The president said he was open to including in a subsequent virus aid package fiscal relief for state and local government — which Democrats had wanted for the current bill — along with infrastructure projects.

Most of the funding, $331 billion, would go to boost a small-business payroll loan program that ran out of money last week. An additional $75 billion would be given to hospitals, and $25 billion would be spent to boost testing for the virus, a key step in building the confidence required to reopen state economies.

Rep. Steny Hoyer, the House majority leader, told a conference call with reporters that House votes would occur Thursday. He said the House will also vote on a proposal to allow proxy voting during the pandemic, a first for Congress, which has required in-person business essentially since its founding.

The Maryland Democrat insisted that proxy voting is “no substitute” for traditional roll calls. But he also wants to go further by opening committees hearings to remote ways of doing business during the crisis.

“The House must show the American people that we continue to work hard on their behalf,” Hoyer wrote to colleagues.

House Minority Leader Kevin McCarthy, R-Calif., wrote Speaker Nancy Pelosi, D-Calif., seeking more information on plans to reopen the House, including an updated schedule, plans for annual Pentagon policy and appropriations measures, and decisions on proxy voting.

But the landmark rules change met with objections from conservative Republicans.

“I don’t support it at all,” said Rep. Clay Higgins, R-La., one of a handful of Republicans who showed up for Tuesday’s pro forma session to protest proxy votes. “Congress should be in session.”

The emerging virus aid package — originally designed by Republicans as a $250 billion stopgap to replenish the payroll subsidies for smaller businesses — has grown into the second largest of the four coronavirus response bills so far. Democratic demands have caused the measure to balloon, though Republicans support additions for hospitals and testing.

With small-business owners reeling during a coronavirus outbreak that has shuttered much economic activity, the administration has been pressing for an immediate replenishment of the paycheck protection program.

Talks have dragged as the Democrats tacked on the health priorities and two sides have quarreled over the design of a nationwide testing regime, among other pieces.

Democrats were rebuffed in a request for another $150 billion in aid to revenue-strapped state governments, but left satisfied that the administration will help deliver such aid in the next aid bill. There’s also pressure to help cities with populations of less than 500,000 that were shut out of the massive $2 trillion relief bill that passed last month.

Schumer said Monday that he had talked to Federal Reserve Board Chairman Jerome Powell and that Powell said the Fed is working to open up the Main Street Lending program to nonprofits and municipal governments.

The emerging accord links the administration’s effort to replenish the small-business fund with Democrats’ demands for more money for hospitals and virus testing. It would provide more than $300 billion for the small-business payroll program, with $60 billion or so set aside — and divided equally — for smaller banks and community lenders that seek to focus on under-banked neighborhoods and rural areas.

Another $60 billion would be available for a small-business loans and grants program delivered through an existing small business disaster aid program, $10 billion of which would come in the form of direct grants.

The government’s Paycheck Protection Program has been swamped by companies applying for loans and reached its appropriations limit last Thursday after approving nearly 1.7 million loans. That left thousands of small businesses in limbo as they sought help. The National Federation of Independent Business, a GOP-friendly organization that advocates for small businesses in Washington, said it had surveyed their members and reported that only 1 in 5 applicants had received money so far.

Controversies have enveloped the program, with many businesses complaining that banks have favored customers with which they already do business. Some businesses that haven’t been much harmed by the pandemic have also received loans, along with a number of publicly traded corporations.

(AP)