Israeli military intelligence and the Shin Bet have opened a high-stakes investigation into what officials now believe was a deliberate exploitation of classified operational data to profit on the prediction platform Polymarket, after investigators linked a series of near-perfect wagers to the final internal planning window for Israel’s June 2025 strike on Iran.

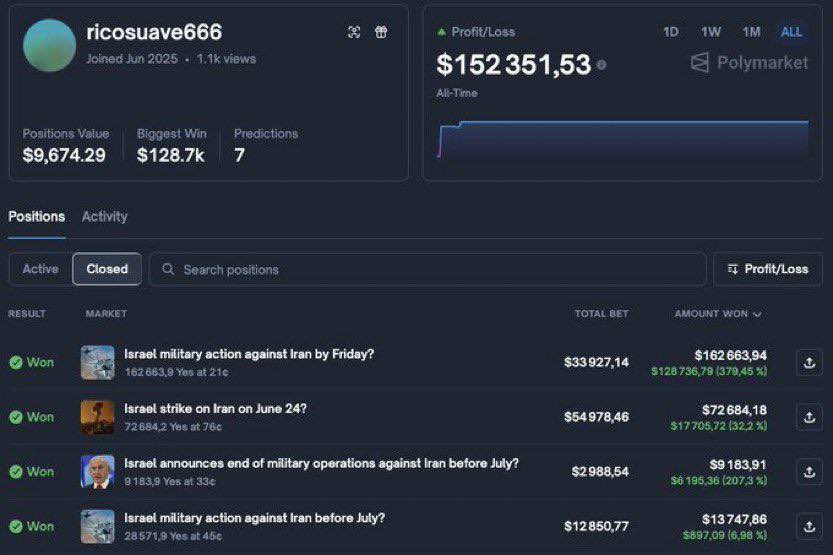

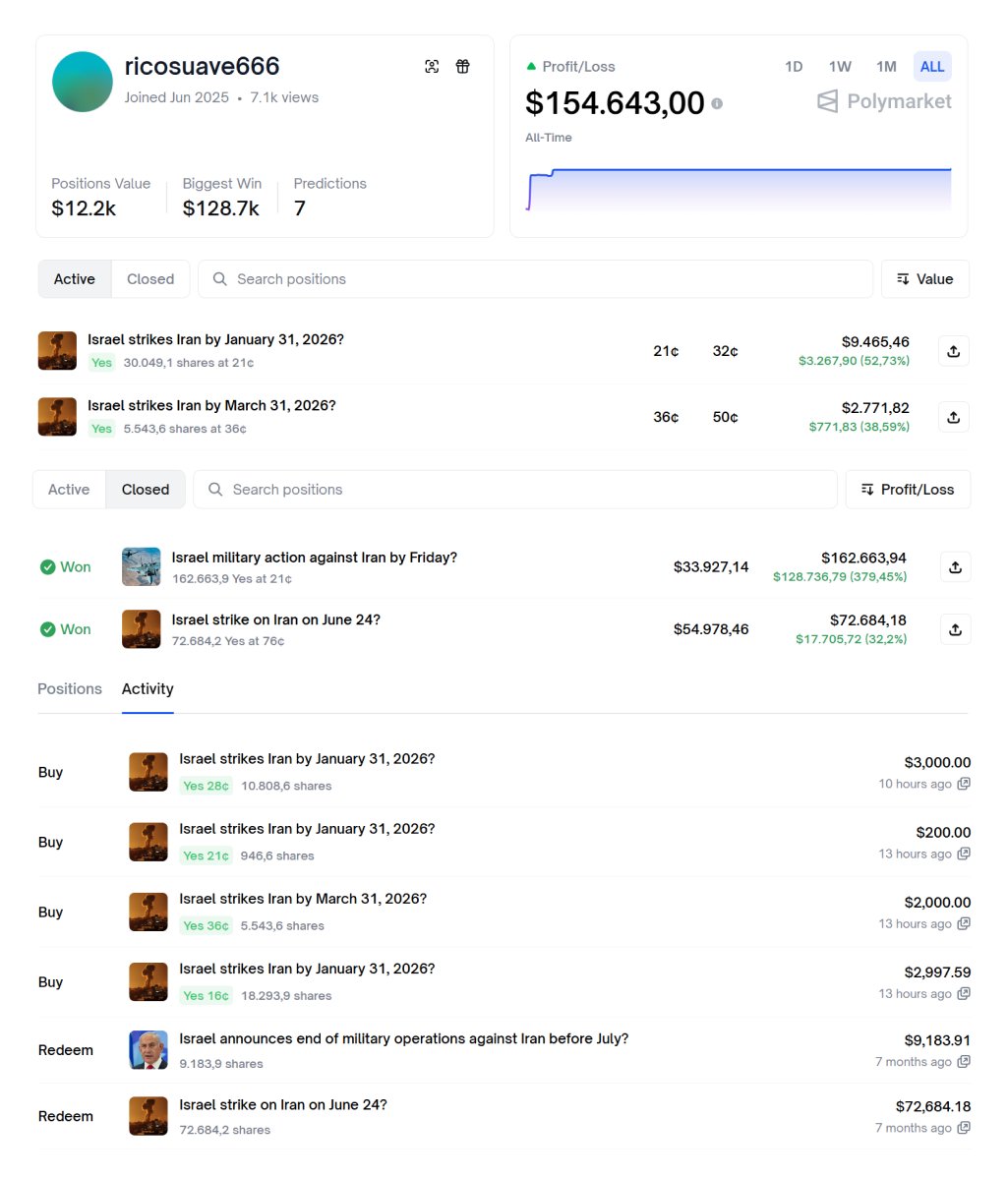

The activity centers on a Polymarket market titled “Israel military action against Iran by Friday?” along with related wagers tied to whether a strike would occur before July.

According to platform data reviewed by investigators, a previously dormant trader returned to the market just 48 hours before the operation and began placing large, high-conviction bets that aligned precisely with Israel’s internal timeline.

For most of June, the market priced the likelihood of a strike at under 20 percent, reflecting widespread public skepticism and media focus on diplomacy. But roughly 36 hours before the attack, a surge of “Yes” purchases sent the odds soaring to 88 percent and then to 99 percent just hours before Israeli F-35I Adir jets entered Iranian airspace. The trader targeted the specific “Friday” resolution, accurately anticipating the early-morning strike on Friday, June 13.

The same account also placed winning bets across multiple related pools, including whether a strike would occur on Iranian soil before July, whether the IDF would announce the conclusion of the operation before July, and whether the strike would hit nuclear-related infrastructure in June. All resolved in the trader’s favor, producing profits estimated at more than $150,000.

Israeli officials say the timing is the red flag. The largest purchases were placed shortly after a classified security cabinet meeting in which the “Friday the 13th” operational window was finalized. Investigators believe the trader was able to buy shares at steep discounts — in some cases as low as 15 to 20 cents — before public sentiment shifted, creating what intelligence officials have described as an “inside advantage” that would not have been available without access to sensitive planning materials.

The investigation has now moved deeply into blockchain forensics, with the Shin Bet using advanced tools to trace crypto wallets tied to the Polymarket account. Officials are focusing on identifying the original exchange used to fund the account, a step that could allow authorities to subpoena Know Your Customer records and link the digital wallet to a real-world identity.

Analysts are also running clustering analysis to map past transactions that could connect the wallet to subscriptions, personal purchases, or transfers to associates, creating a behavioral fingerprint.

At the same time, investigators are cross-referencing the exact timestamps of the bets with internal access logs from the IDF and Shin Bet, looking for officials who were logged into classified systems or present in briefing rooms when the final strike window was confirmed.

Intelligence officials say the suspect’s most vulnerable point may come when attempting to cash out. Converting crypto winnings into spendable currency typically requires passing through regulated financial channels, creating what one cyber-intelligence source described as a “chokepoint.”

“The blockchain is a ledger that never forgets,” the source said. “You can hide for a short time, but the moment you try to turn that profit into real money, the trail tightens.”

Beyond the digital hunt, the Shin Bet has reportedly launched mandatory polygraphs focused on personnel in the IDF’s targeting and operations circles who had access to the June 13 date, along with forensic reviews of personal devices for crypto-wallet apps or decentralized finance tools.

No suspect has been publicly named, but officials say the widening probe reflects the seriousness with which Israel’s security establishment is treating what it views as a top-tier national security breach at the intersection of modern finance and classified military planning.

(YWN World Headquarters – NYC)