As the budget dogfight continued in Washington on Friday, we finally heard some good news: the unemployment rate went down below the 9% mark, as employers in the private sector hired another 222,000 people on the payrolls. Unlike the disingenuous report in January that lowered the unemployment rate while delivering disturbing news about a drop of over a half a million people in the labor force, the February jobs report indicated that the size of the labor force increased by 60,000. However, as the Republicans and President Obama prided themselves and took credit for the positive report, we have much to worry about: the employment rate is still at a 58.4% low with only 64.2% in the work force – the lowest in 25 years. It’s a muffled recovery that has a long way to go. This also excludes those working part time – 8.3 million – who’d rather work full time. Yet, despite its slow response, the economy is growing as the unemployment rate is declining, and we must ensure that the recovery continues and doesn’t falter to become a double-dip recession.

As the budget dogfight continued in Washington on Friday, we finally heard some good news: the unemployment rate went down below the 9% mark, as employers in the private sector hired another 222,000 people on the payrolls. Unlike the disingenuous report in January that lowered the unemployment rate while delivering disturbing news about a drop of over a half a million people in the labor force, the February jobs report indicated that the size of the labor force increased by 60,000. However, as the Republicans and President Obama prided themselves and took credit for the positive report, we have much to worry about: the employment rate is still at a 58.4% low with only 64.2% in the work force – the lowest in 25 years. It’s a muffled recovery that has a long way to go. This also excludes those working part time – 8.3 million – who’d rather work full time. Yet, despite its slow response, the economy is growing as the unemployment rate is declining, and we must ensure that the recovery continues and doesn’t falter to become a double-dip recession.

A cure cannot be prescribed without identifying the illness, a faltering business cannot be amended without discovering the setback, and an economy cannot be boosted without recognizing the problem. Economists looked with concern at the recent economic downturn that confirmed unprecedented information. For the first time in history, techniques that were generally used to fix an economy in the time of a recession gave no results. Congress passed stimulus bills with trillions of dollars in spending together with bailout packages to boost the GDP, but it didn’t yield. The money supply was increased to record levels to raise price levels, as the Feds lowered interest rates and engaged in quantitative easing, but to no avail. The economy was in stalemate without the light at the end of the tunnel in sight.

Gross domestic product – the structure of an economy – has four divisions: personal consumption (sales and services), capital purchases and investments, government expenditures (excluding transfer payments) and net exports. A boost in either section advances the economy. Thus, John Keynes claimed that the cure for a shaky economy is government intervention. However, as Congress and the Obama administration spent trillions of dollars to stimulate the economy making government spending more than 40% of the GDP, economists were wondering why it has no effect. As Ben Bernanke divulged into the monetarism school of thought, people were wondering whether the record low interest rate won’t worsen the economy in the long-run while it had little effect on stopping the recession. The government expenditure had virtually no effect as consumption and investment was crowding out. The question lingered as desperation grew.

The answer of course was confidence. John Keynes and Milton Friedman have answers to the economy but don’t have solutions to restore consumer confidence. As the Feds hoped to boost the money supply, businesses were stashing the cash in hiding hoping for better days. Instead of hiring, businesses put away reserves for more rainy days they were scared would come – it kept the economy deadlocked. The way to reinstate the economy was to restore confidence. At last, 63% of private-company executives said this month that they’re optimistic about the US economic prospects – compared to just 39% last year.

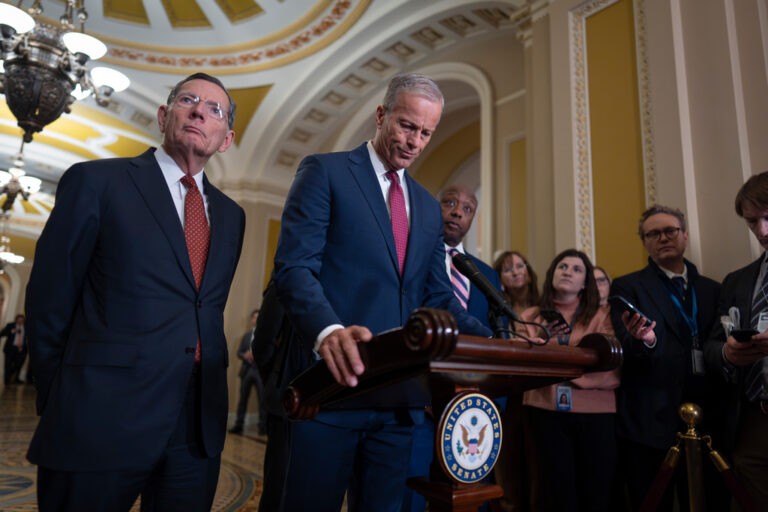

John Boehner and President Obama both hailed the extension of the tax-cuts as the reason for the positive jobs report. It was interesting to note that even President Obama gave his stimulus bills no credit in his weekly address. Yet, while the tax cuts might’ve had some effect on the jobs report, it is unlikely that it was the actual cause for the boost. No big change went into effect with the extension of tax cuts other than some temporary hiring; businesses won’t hire long-term employees because of a short-term extension of tax cuts. John Boehner said: “Removing the uncertainty caused by those looming tax hikes provided much-needed relief for private-sector job creators in America.” However, he too agreed that excessive government spending may have a negative impact on the economic recovery. While those on the left claimed that the Republicans seek to stall the recovery with the spending cuts, Chairman Bernanke largely disagreed on that notion and House budget Chairman Paul Ryan claimed that it would actually advance the recovery.

Paul Ryan has a point: the United States is broke. Spending money we don’t have is immoral and a formula to put a country further in decline. It is ironic that Bernie Madoff had to lecture the government about the Ponzi scheme it is running. It was like a pirate warning drunken sailors about the journey they are taking; nevertheless, it was a warning worth heeding. At the rate we are going, government spending will account for nearly 200% of our economy by the year 2040. It is the excessive spending for unsustainable programs that is stalling the recovery process. It only makes sense that the boost in consumer confidence comes after the GOP-led House opposed more government spending and proposed major cuts. Businesses know that more debt will lead to higher interest rates which will make investment more expensive. Saving their money or borrowing more at record low interest rates seemed viable to them – it would prepare them for the famine they dreaded.

The economic problem this time around isn’t just the fact that businesses aren’t spending – it is why they’re not spending. It is the monstrous government of red tape and record debt levels that is the cause. The recovery now lies in the hands of the lawmakers that won’t stop pandering to special interest groups and refuse to use the hatchet for entitlement programs. President Obama is right: a deal to extend the government for two weeks isn’t enough; we need a permanent “road map” to recovery. We must ensure that we continue cutting government and make it more effective. President Obama promised to call the bluff of anyone who talks a good game on reducing the national debt but doesn’t act. We call on President Obama to hear his call and stop dithering. We call for his leadership to further boost consumer confidence and the economy.

Dave Hirsch is a political analyst and featured columnist. His opinions have been featured in numerous publications. He can be reached at [email protected]

NOTE: The views expressed here are those of the authors and do not necessarily represent or reflect the views of YWN.

DO YOU HAVE AN OPINION YOU WOULD LIKE TO SEE POSTED ON YWN? SEND IT TO US FOR REVIEW http://www.theyeshivaworld.com/contact.php

(YWN World Headquarters – NYC)

5 Responses

don’t spend what you don’t have Our grandparents operated this way.

I find that the best way to read this opinion is to imagine that the speaker is Slip Mahoney or Ed Norton. The author of this opinion is, apparently, a political analyst. Since the article is about economics, not politics, the author is no more qualified to write this article than a nephrologist.

Large budget deficits can have bad consequences. They can lead to high interest rates, the need for government finance can crowd out private investment, and they can lead to a decline in the value of the currency.

None of these things are happening. Interest rates remain at near record low levels. Businesses aren’t investing because there is no consumer demand. And the dollar is stronger against the Euro, the most important alternative currency, than it was before the collapse.

And of course the huge tax cut extension added over $800 billion to the deficit. Somehow Republican ideas for adding to the deficit are ok, but not Democratic ideas.

Basically, the article is full of ideology, not reality.

One more point: A decline in the value of the dollar would not be bad. It would make our exports more competitive.

So do we do this by raising taxes (I know, raise someone else’s taxes, not mine), or by reducing government spending (I know, cut someone else’s program, not the ones that benefit me). Perhaps we can cut the debt by monetarizing it (worked “fine” in Germany 90 years ago).

There’s no hidush that reducing the debt will foster growth. The problem is that no one, tea party included, wants to give up anything meaningful.