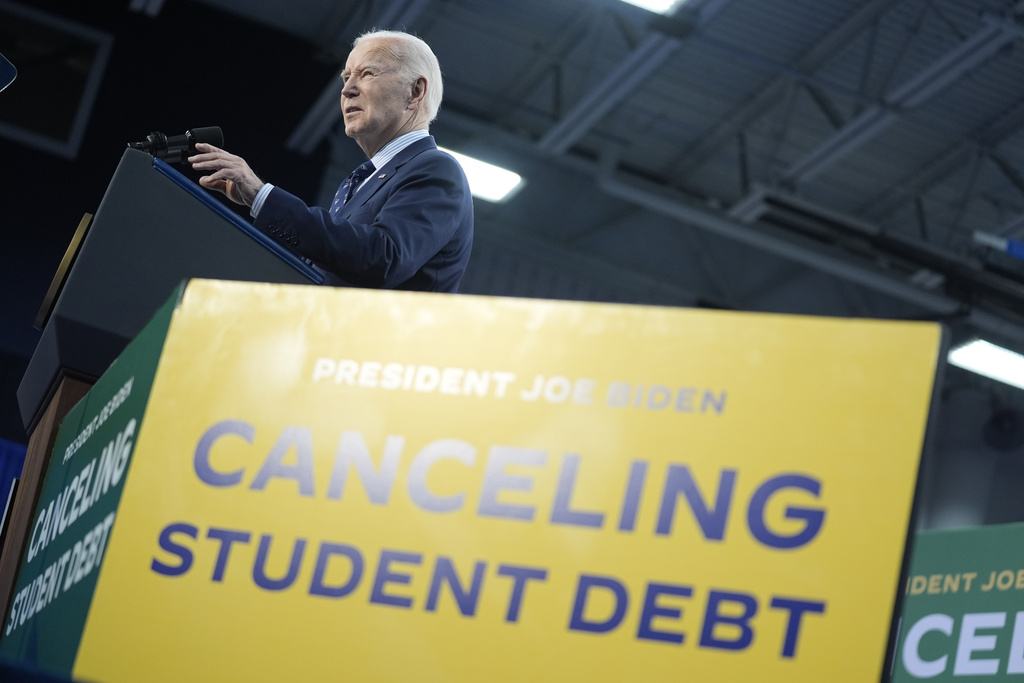

Another group of Republican-led states is suing to block the Biden administration’s new student loan repayment plan, which offers a faster path to cancellation and has already been used to forgive loans for more than 150,000 borrowers.

Seven states led by Missouri filed a federal lawsuit Tuesday challenging Biden’s SAVE Plan, which has become a new legal target for conservative opponents after the Supreme Court toppled the Democratic president’s first attempt at student loan cancellation. It largely mirrors another suit filed last month by Republican attorneys general in 11 states, led by Kansas.

“Yet again, the President is unilaterally trying to impose an extraordinarily expensive and controversial policy that he could not get through Congress,” according to the new suit.

Filed just a day after Biden trumpeted a new proposal to cancel student loans for millions of borrowers, the lawsuit sets the stage for one legal battle and foreshadows another. The suit doesn’t directly challenge Biden’s newest plan for cancellation, but its architect, Missouri’s attorney general, separately threatened to bring action against that plan, too.

A statement from the Education Department says Congress gave the agency power to define terms of certain repayment plans in 1993, and that authority has been used before.

“The Biden-Harris Administration won’t stop fighting to provide support and relief to borrowers across the country — no matter how many times Republican elected officials try to stop us,” the department said.

The lawsuit reprises a courtroom showdown between the Biden administration and Missouri, which was a central figure in the Supreme Court case that overturned the Democratic president’s first try at loan cancellation last year.

In that case, the Supreme Court found that loan cancellation would harm Missouri because of its affiliation with a quasi-state loan servicing company, MOHELA, that stood to lose revenue generated by federal student loans.

The new lawsuit makes a similar argument. Biden’s new SAVE Plan speeds up an existing path to loan cancellation, which the suit says would deprive MOHELA — the Missouri Higher Education Loan Authority — of “up to 15 years in servicing fees.”

Also joining the suit are Arkansas, Florida, Georgia, North Dakota, Ohio and Oklahoma.

The Biden administration launched the SAVE (Saving on a Valuable Education) Plan last year, calling it a “student loan safety net.” It’s a modified version of other repayment plans that have been around for decades, but with more generous terms.

Congress created income-driven repayment plans in the 1990s to help borrowers who were struggling to make payments on student loans. Those plans capped payments based on a borrower’s income and promised to cancel any remaining debt after 20 or 25 years.

Biden’s SAVE Plan reduces monthly payments even further and forgives loans in as little as 10 years. The president announced the idea in 2022, but it was overshadowed by his call for widespread cancellation.

Almost 8 million Americans have enrolled in the plan, including 4.5 million low-income borrowers who have had their monthly payments reduced to $0.

The plan’s provisions are being phased in this year, with the faster path to cancellation originally scheduled to take effect in July. But the Biden administration accelerated that benefit and started canceling loans for some borrowers in February.

Along with the harm to MOHELA, the lawsuit alleges that Biden’s plan makes it harder for states to hire and retain employees. The repayment plan is so generous, according to the suit, that it undermines the Public Service Loan Forgiveness program, which allows borrowers to get student loans canceled after 10 years of work in public service jobs.

It’s an important recruiting tool for states, according to the lawsuit — out of 13 law school graduates hired by the Missouri attorney general’s office last year, almost all said Public Service Loan Forgiveness influenced their decision to work in the public sector.

“Once the Final Rule takes effect, however, PSLF will not be nearly as attractive compared to other income-driven repayment programs,” the suit says. “Its comparative advantage will shrink or disappear entirely.”

The states note that more than half of borrowers in the plan are paying nothing. “This is not a student loan program. It is a grant program that Congress never authorized,” according to the suit.

Separate from the repayment plan, Biden on Monday highlighted a new proposal that aims to reduce or cancel student loans for 30 million Americans. It would offer loan relief to five categories of borrowers, including those who have amassed large sums of accrued interest, those who have been paying loans for decades, and those who face financial hardship.

Hours after Biden unveiled it, Bailey took to social media, calling the proposal an illegal attempt to bypass Congress.

“The rule of law means something in this country,” he wrote. “See you in court.”

(AP)

One Response

This shows why the traditional way political machines paid for the loyalty of supporters involved the local ward boss “walking around” with large amount of currency (paper money, what was used in the old days before debit and credit cards were available) and handing it out the supporters in need. Tammany was a lot cleverer than Biden (and probably had higher principles – welfare to college graduates will greatly annoy those who didn’t get student loans and have lower incomes).