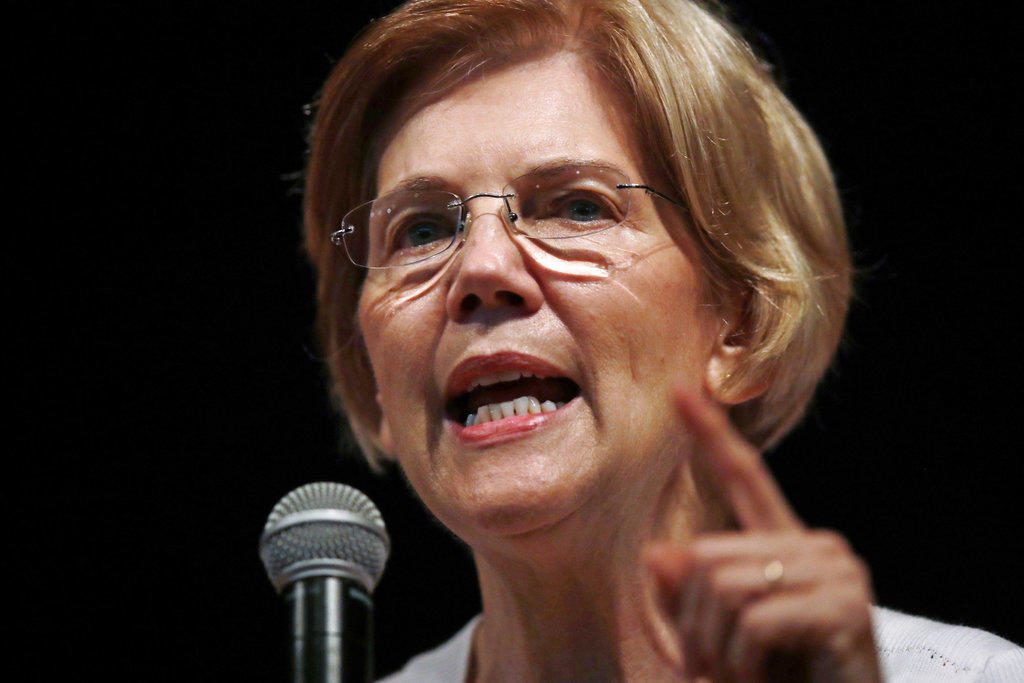

Sen. Elizabeth Warren is proposing a so-called ultra-millionaire tax as she vies for the 2020 Democratic presidential nomination.

According to two economists advising her presidential campaign on the plan, the tax would hit an estimated 75,000 of the wealthiest American households.

The new tax plan released Thursday by the Massachusetts Democrat would impose a new 2 percent fee annually on American households’ net worth greater than $50 million.

The overall new tax bill on wealthy households would rise to 3 percent for households on their net worth above $1 billion under Warren’s plan.

Economists Emmanuel Saez and Gabriel Zucman of the University of California, Berkeley, project that the tax proposal would generate about $2.75 trillion over 10 years.

Warren opened an exploratory committee for the 2020 presidential race last month.

(AP)

5 Responses

good idea, but who gets the money? this is only viable if congress also cuts spending, also stops foreign wars, also cuts the military budget, also cuts out all the excessive parts of the budget, also stops bank bailouts

Is she raising taxes on american indian tribes and reservations?

She must also be 1/1024th Venezuelan with such a pointless promise.

Only the truly out of touch political ruling class can think up things that will help absolutely no one, or that no one will notice anything positive from.

“generate about $2.75 trillion over 10 years.” Berkley doesn’t bother to divide that by 10 to tell me what the per year number is. I have a list of things Congress has passed recently. Millions to teach kids in China how to cross a street for example. This really puts food on the tables eh?

It will drive capital offshore and cause a recession that will wind up costing more than the amount generation. It’s been tried many times and it never works.

Why not just tax them an 96%?

It’s just straight out thievery

We need money, OK we will take yours. So simple.