The following is by DansDeals:

Everyone loves earning points and miles, and they should. It’s allowed me and many others to travel the world in first class and stay in five star resorts for free.

But depending how you earn those points, some people end up paying a very high price.

5 years ago I wrote about a couple of scams that were being discussed on DDF. I was sent threats for writing about it, but something had to be done before others fell for scams like Sungames that promised impossible returns from a flimsy business plan and credit card farms that paid a lump sum for all of your personal information and the right to open credit cards in your name.

I followed up on them 2 years ago after Sungames went up in flames, but sadly people kept on getting financially ruined by credit card farms after handing over the keys to all of their personal information. Once again I reminded readers that the promise of a financial windfall is never worth the potential damage that can be caused by someone else with all of your personal information.

The latest scheme that people are falling for is allowing others to charge your card and getting paid back after a few weeks in order to earn miles. DDF moderator Chaikel first wrote about this years ago, but over the past few months there have been multiple cases involving tens of millions of dollars each of money that has been stolen.

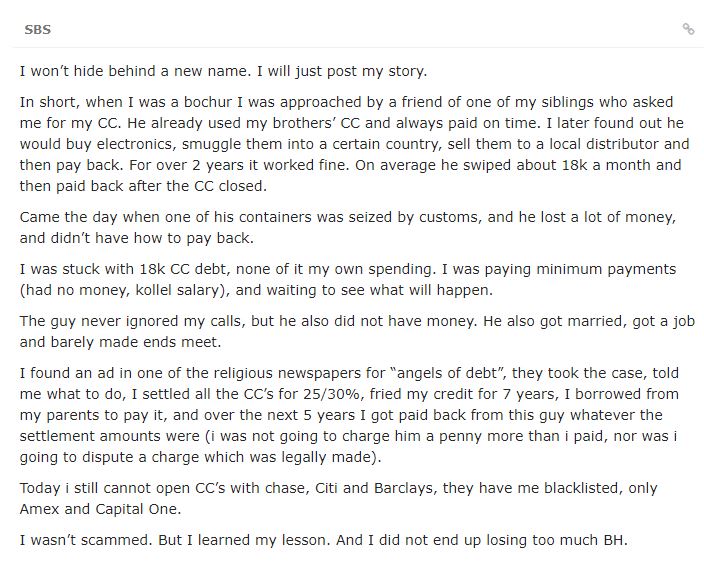

One DDF member with thousands of posts was too embarrassed to post under his regular forum name, so he opened a new account to share his experience. In short, he allowed businesses to spend hundreds of thousands of dollars on his cards each month and enjoyed getting the points. The business paid back everyone monthly for years, but they now owe between $15MM-$18MM to people and they say that the money is gone. The DDF member is personally out more than $300,000, and many others are in the same boat at risk of losing their life savings or having to face bankruptcy and more than 7 years of not being able to get credit.

Another DDFer with thousands of posts also opened a new account to share that he fell prey to a different but similar scam and lost hundreds of thousands of dollars. I’ve received emails from several other people as well that asked me not to share their names, but to please make a post about this so that others don’t fall for the same scheme.

It’s no simple matter to just dispute that kind of charge if you gave permission for your card to be used as that does not qualify as a fraudulent charge. Claiming that a charge is fraudulent when it is not can get you into legal hot water. Courts can look into your records to determine if you authorized your card to be used and false claims can take you from a scary personal bankruptcy case to a far more scary criminal case.

If you’re in such a case you would be well advised to find a good lawyer to help you navigate your way out.

As I’ve said at every DansDeals Seminar, do not open a credit card if you are going to go into debt for it, as that will quickly eat up any gains you made. If you can’t treat your credit cards the same way as you do cash, then shred them today. That applies equally to spending beyond your means and lending your credit card line to others. It also applies to buying groups. You should never lend more than you can afford to lose, no matter what the scenario.

A business that uses your credit line or takes your goods without paying upfront can be run by seemingly honest people for years and then suddenly default on everyone’s payments with checks that bounce or by just ignoring you. It’s this simple: If you wouldn’t hand over a briefcase full of cash to someone, then don’t hand over your credit card or goods that you paid for, that you can’t afford to lose.

There’s a reason a business is asking you for credit. If a bank won’t give them the credit they need after doing due diligence, then common sense should say that you shouldn’t be either. It doesn’t matter if it’s a big business, or a trustworthy neighbor, friend, or relative, the same rules must apply. A loaning scheme may start off innocently, but once things start to go south it can force a business to default on loans, even when its operated by the most honest people.

The mileage system is all fun and games until you start to let it control you. It’s time that people stop thinking of miles and points (as well as anything else) as a get rich quick scheme, as that has led too many down a dangerous path. It’s great to optimize your spending to earn lots of points if you can properly track everything and not let things get out of hand. But it’s time to take a step back when you reach a point where you are handing over thousands (or hundreds of thousands!) of dollars of your credit line or goods when you would never go to a bank and hand over your life savings to anyone.

I’m sad that I have to write this post and say this, but it’s not a game folks, it’s your future. Never give anyone your personal information and never give anyone access to your credit line or to goods that you paid for unless you realize that it is the same as cash and can afford to lose it all.

My heart goes out to the victims here and I’m not here to assign blame, they have a hard enough pill to swallow. But hopefully others will take their hard learned lesson to heart and act in a financially responsible manner.

6 Responses

Don’t trust someone you don’t know

There are multiple separate stories at this time affecting hundreds of unsuspecting victims, many of them kollel yungerleit and others who face financial ruin. Many owe $100,000 or more between themselves, their spouses, and other relatives. Their sholom bayis is affected, their already meager financial situation is in ruins, and they don’t know where to turn.

Please remember: no matter how solid the business looks, no matter how ehrlich the guy seems, and no matter how many of your friends boast of the points, and money they are making:

If you give out your credit card or social security number, you are handing someone the equivalent of a briefcase full of cash, with no security, no guaranteur, and no recourse if the business runs into trouble.

No bank or lender would lend on those terms, not even for a huge return. Many of the victims thought they had a sure thing. They though they had done their research going with well known businesses with seemingly healthy profits, only to find out that it was just a pile of debt waiting to collapse.

התורה חסה על ממונם של ישראל

Just how does a bochur get an $18, 000 credit limit to begin with?

Amil,

Who told you how old the bachur was??

Besides; I don’t know how the CC companies work exactly but they provide me with credit lines of $10-18,000 left and right, amounting to roughly 70% of my income.

It seems these “schemes” are a total violation of the CC terms of service. This is gzeila from the CC companies, not to mention gneivas daas, dishonest business dealing, supporting potentially illegal operations that violate customs laws, and a violation of dina demalchusa. Telling people “don’t risk more than you can afford to lose” is essentially telling people to do these aveiras, as long as they can live with the financial consequences. When did financial gain become a heter to violate halacha? When did bitachon in the Ribono Shel Olam with an honest parnassah become insufficient, to the point where “Yeshiva World” can shamelessly post articles advocating for crookedness and assur behavior?

Uncle Mo per the article and my post no mention was made of the bochers age. He did disclose he did not work ergo my question.